This guide describes how to access invoices in the EAS Merchant Dashboard and what actions can be taken on the invoices.

Access to EAS dashboard

Ensure that you have access to the EAS dashboard. EAS dashboard is available at https://dashboard.easproject.com/. If you cannot access the dashboard , please, write to support@easproject.com to receive a new password link.

For more details please refer to the EAS merchant dashboard and reporting

Invoice management guide

Invoice management is available from Menu option "Invoices"

Choosing the “Invoice” tab allows viewing the list of all invoices that are sorted by the due date. The following information is available in this view: Invoices in pdf form, Invoice breakdown files, Payment links for unpaid or partially paid invoices.

By pressing arrow to down near Amount value will display invoice amount breakdown.

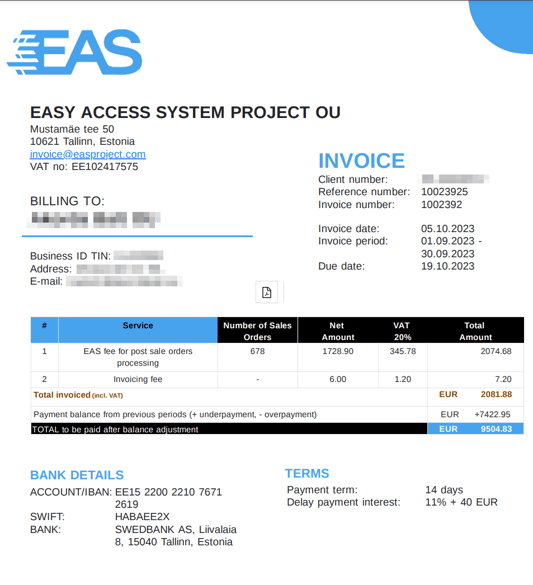

Button Invoice ![]() allows for download of the chosen invoice in PDF form, as shown below: (Note that the design may change):

allows for download of the chosen invoice in PDF form, as shown below: (Note that the design may change):

Detailed invoice breakdown report in excel readable CSV form can be downloaded by pressing button Breakdown ![]() .

.

If detailed invoice breakdown report does not appear as a table in Excel please read the article How to open CSV file in Microsoft Excel

Payment link is active for all unpaid or partially paid invoices. It can be activated by pressing button ![]() for a particular invoice.

for a particular invoice.

If invoice not paid till the end of the month, payment link will be disabled, unpaid amount will be moved to next invoice.

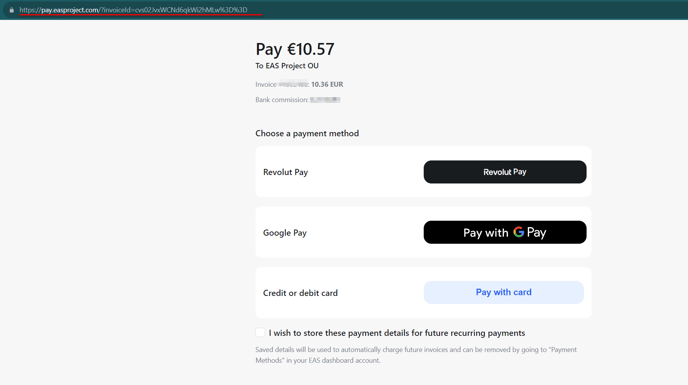

The link will open in a separate window:

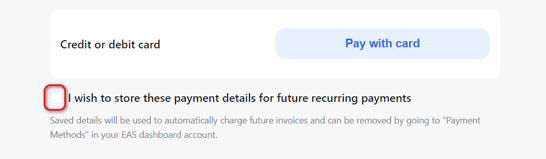

Payment card that is used via a payment link can be saved for future recurring payments by ticking the box at the bottom of the link. "I wish to store these payment details for future recurring payments"

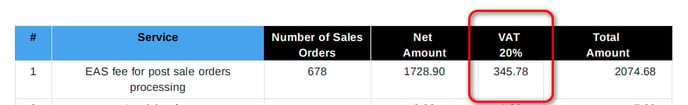

If Customer registered in Estonia, then additional VAT (20%) will be charged on the EAS fee.

The bank that EAS uses for clearing payment cards charges fees for card payments. But all EAS invoices can be paid by a SEPA or SWIFT payment. We suggest that you do not use payment cards if your due payment is over 500 EUR to ensure that you do not pay bank card fees.