This guide describes how to access Reports in the EAS Merchant Dashboard and what actions can be taken on the reports.

Access to EAS dashboard

Ensure that you have access to the EAS dashboard. EAS dashboard is available at https://dashboard.easproject.com/. If you cannot access the dashboard , please, write to support@easproject.com to receive a new password link.

For more details please refer to the EAS merchant dashboard

Reports management guide

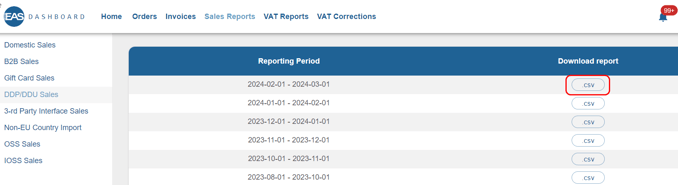

Orders management is available from Menu options "Sales Reports" and "VAT Reports"

Sales reports are used mainly for accounting purposes. VAT reports are for reporting purposes.

Sales reports types.

The Merchant’s sales in the sales reports are grouped based on applied tax schemes to simplify application for accounting purposes.

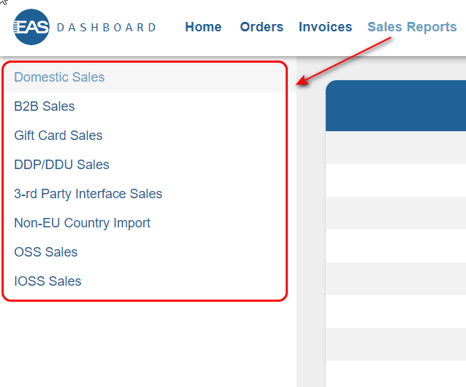

All available sales reports will be displayed on the left side panel.

You will see the list of sales report types only available for your account.

If no sales for particular type never registered by EAS solution, this type will not be listed.

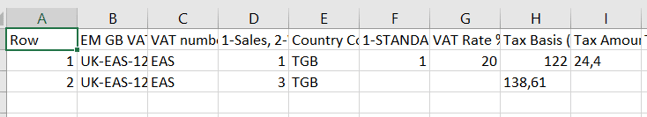

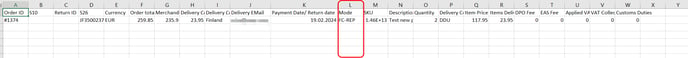

All sales reports are made on the item level (see enclosed are in the figure below which represents a single order).

![]()

Shipping is assigned to the thirst order item (for post sale orders) or weighted to all the items (integrations with live EAS landed cost engine).

If the report does not contain VAT (B2B or DDU sales reports) there will be no VAT shown for the sales. DDP sales report will contain the amount of customs duties.

Sales reports slightly variate to include/exclude additional data but follow the same logic, for example, DDU/DDP reports contain a column that references the sale as DDU/DDP (see figure below)

Items sold in one order may end up in different reports , i.e. physical item and a downloadable service sold from abroad to EU will end up in IOSS and Non-Union schemes

The following sales reports (prepared monthly) are accessible to the Merchant:

- B2B sales report (1)

- Domestic sales report (2)

- Third party interface sales report (OMP) (3)

- DDP/DDU sales report (4)

- OSS Union special VAT scheme sales report (5)

- Digital sales (OSS Non-Union special VAT scheme) sales report (6)

- IOSS (Import OSS import special VAT scheme) sales report (7)

- Gift card sales report (8)

- Non-EU Country import (9)

Click on the Report type to get list of available reports.

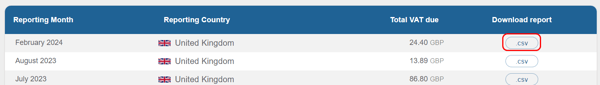

Reports can be downloaded in csv format by pressing the “.csv” button.

All sales reports can be accessed in the same way and for simplification reasons no reference is made to the access sequence of actions. The content of the reports will be discussed further in detail.

1. B2B sales report

B2B monthly sales report contains cross border sales (or domestic sales made when article 194 of VAT directive 2006/112/EC) made to legal entities in the EU. Both sales from other EU countries (EU cross border sales) and third non-EU countries end up in the report. For example, a sale made from a warehouse in Germany to a French legal person end-customer and a sale made from China to a Spanish legal person end-customer will end up in this report.

B2B domestic sales (with positive VAT) are placed in domestic sales report

All B2B sales in this report are accounted for with 0 VAT.

2. Domestic sales report

Both B2B domestic sales and B2C domestic sales end up in this monthly report on item level. All sales in this report are accounted for with the applicable VAT rate of the EU member state of the end-consumer.

3. Third party interface sales report (OMP)

OMP (online market place) monthly report is only generated for E-Merchants that act as EI (Electronic Interface). Additional consultation for such Merchants is available at request. The following sales end up in this report:

Sale of electronic services (B2B and B2C).

- EI facilitates the sale of B2B and B2C electronic services supplied by EU and non-EU underlying suppliers and acts as disclosed agent (EI is not liable for VAT and only needs to keep sales records). On a practical level, it implies that the sale is done by the underlying supplier and not by the E-Merchant and end-customer is aware of that. In such situations, the E-Merchant has a contractual arrangement with the underlying supplier on providing services to that underlying supplier and acts as an agent who acts on behalf of another person (the underlying supplier).

EAS solution will calculate VAT where applicable (when the sale is domestic).

In the above cases of B2B and B2C EI facilitated sales the following attribute also has to be filled for proper operation: “Originating Country” (for electronic services it is the country of underlying supplier or underlying supplier’s fixed establishment that conducts the sale of such services – this information should be procured by the E-Merchant from the underlying supplier).

Sale of goods (B2C only)

- EI facilitates B2C sale of EU goods supplied by EU underlying suppliers and acts as a disclosed agent (EI is not liable for VAT and only needs to keep sales records).

- EAS solution will calculate the VAT rate of the End-customer (when the sale is domestic or sold under the Union OSS scheme).

In all the above cases of B2C EI facilitated sales, the following attribute also has to be filled for proper operation: “Seller registration country”, “Warehouse country”.

EAS will separately inform you about special settings for your store.

The following examples show the sales results in the EI facilitation reports.

The following items have been specifically assigned with the following attributes and tested to produce the standard reports.

4. DDP/DDU sales report

This monthly report includes B2C sales made with cross border fulfilment of items that do not fall within the Import OSS VAT special scheme category:

- Cross border orders with an intrinsic value over 150 EUR with full landed cost calculation DDP (customs duties are included);

- Cross border orders with an intrinsic value over 150 EUR with not taxes calculated/collected DDU.

The merchant does not need to register for DDU/DDP operation mode, it becomes automatically available with Import OSS registration.

5. OSS Union special VAT scheme sales report

This monthly report shows B2C cross border sales made within the EU. EU registered merchants (or Non–EU merchants that have at least one Fixed establishment in the EU) can sell both goods and services under Union OSS VAT special scheme.

Non-EU merchants that have no Fixed establishments in the EU but are registered for VAT in any EU country can sell only goods in the EU.

6. Digital (OSS Non-Union special VAT scheme) sales report

This monthly report shows B2C sales made by Non-EU e-merchants to the EU countries. These merchants can sell only services under Non-Union OSS VAT special scheme.

7. OSS import special VAT scheme report

This monthly report shows B2C import sales of LVC (parcels with an intrinsic value below 150 EUR) made to the EU countries by EU and Non-EU registered merchants

8. Gift card sales report

Sales of multiuser vouchers (gift cards) is reported in this report. Gift cards are not considered as VAT sales.

9. Non-EU Country import sales report

Domestic and cross border sales to Non-EU countries for physical and downloadable products are shown in this report. Both DDU/DDP and LVC (low value consignments) sales will be included.

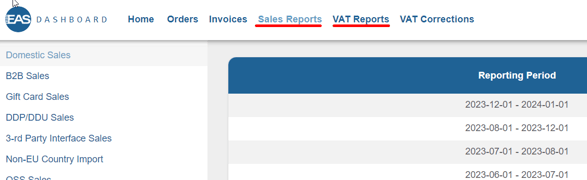

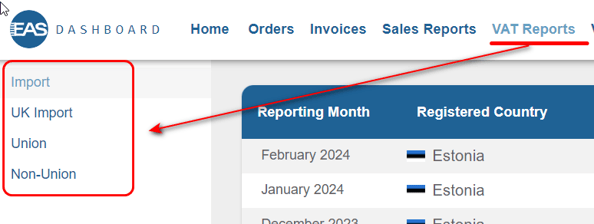

Fiscal VAT Report

Fiscal reports can be provided to the fiscal authorities in the EU country of identification for the special schemes.

The following reports can be found in this section (see Figure below ) :

- OSS import fiscal report (prepared monthly) (Import)

- OSS Non-Union fiscal report (prepared quarterly) (Non-Union)

- OSS Union fiscal report (prepared quarterly) (Union)

- UK import report (prepared monthly) (UK Import)

Click on the VAT reports and list of available reports will be displayed on the left side panel

List of available report may vary and depends on the store configuration.

Fiscal reports correlate with respective special VAT scheme special reports with consideration for reporting periods. Thus, the first quarter OSS Union fiscal report contains information on cross border B2C sales made to EU end customers during January, February, and March of the respective year which are also duly presented in the monthly OSS Union special VAT scheme sales reports for respective months.

Additionally, to reporting sales, fiscal reports may contain corrections applied to previous reports as prescribed and allowed by the applicable legislation. Corrections are explained in Section Menu option “VAT Corrections”. Detailed guide available at Manual VAT corrections

UK import reports are prepared for United Kingdom of Great Britain and Northern Ireland. In future releases new countries will be added

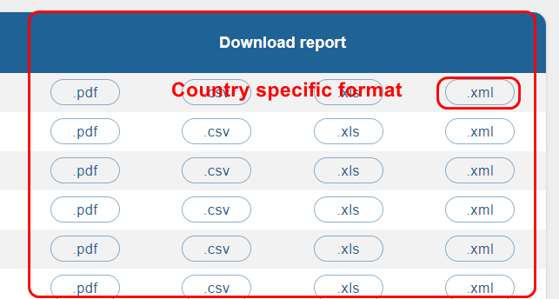

Fiscal reports are available in pdf, csv and excel format. All reports forms contain the same data prepared for different purposes.

“Country specific format” report is a special form of a report that can be uploaded directly to the national tax authority’s portals.

In most cases EAS will automatically file your IOSS and Non-Union OSS reports for you. You need to file OSS Union reports yourself. In some cases the Merchant also shall file IOSS and Non-Union reports (depending on integration type and employed schemes). EAS will explain to the Merchant if the filing should be done by the Merchant during the integration.

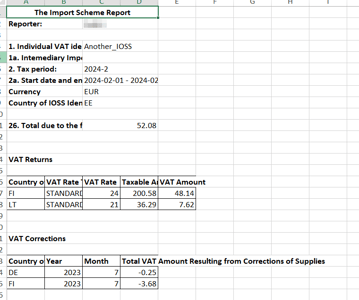

All EU special scheme reports (in csv and excel format) have similar structure. IOSS report contains data for the reporting month, Union OSS and Non-Union OSS reports contain quarterly data.

|

Entries for all EU countries to which sales were made will be shown. There may be 2 or 3 entries for a country if reduced and standard rate sales were made .

|

1. Import OSS fiscal report

Import OSS fiscal monthly report for the respective OSS scheme reflects all sales and corrections made with the use of the Import OSS VAT special scheme. The report is fully equivalent to the monthly sales Import OSS report when it comes to the sales volumes and due VAT but prepared to suit the requirements of the national fiscal authorities (the tax authorities of the Merchant’s country of identification) and applicable EU legislation.

By pressing the “IOSS reports” button (from available repot types) and choosing “Download Excel” button the Import OSS fiscal report will be downloaded:

2. OSS Non-Union fiscal report

Non–Union OSS fiscal quarterly report for the respective OSS scheme reflects all sales made with the use of the Non-Union OSS VAT special scheme. The report is fully equivalent to the 3 monthly sales Non-Union OSS reports (in the respective quarter) when it comes to the sales volumes and due VAT but prepared to suit the requirements of the national tax authorities (the tax authorities of the Merchant’s country of identification) and applicable EU legislation.

By pressing the “Non Union OSS reports” button (from available repot types) and choosing the “Download Excel” button with the required period, the Non-Union OSS fiscal report will be generated. The report is similar to the IOSS report but represents data on quarterly basis.

3. OSS Union fiscal report

Union OSS fiscal quarterly report for the respective OSS scheme reflects all sales made with the use of the Non-Union OSS VAT special scheme. The report is fully equivalent to the 3 monthly sales Union OSS reports (in the respective quarter) when it comes to the sales volumes and due VAT but prepared to suit the requirements of the national tax authorities (the tax authorities of the Merchant’s country of identification) and applicable EU legislation.

All sales are identified in accordance with the consumption countries against respective Fixed establishments/countries of VAT registration where the deliveries were made from as required by EU regulations with notification of VAT ID numbers of such Fixed establishments or VAT registrations.

Supplies made by EI acting in accordance with Article 14(a)2 (deemed supply of EI goods that are provided by non-EU underlying suppliers) are notified without VAT registration numbers as required by EU regulations.

By pressing the “OSS reports” button (from available repot types) and choosing the “Download Excel” button with the required period, the Union OSS fiscal report will be generated, which is similar to IOSS and Non-Union OSS reports.

4.UK import fiscal report.

UK fiscal reports are prepared for United Kingdom of Great Britain and Northern Ireland on monthly basis and are available when “Download CSV” button is pressed:

Report contains aggregated sales and VAT data :