E-commerce environment : WooCommerce Merchant: UK based, VAT registered in the UK or VAT not registered in the UK.

This topic explains the details of tax setting for UK based company using only IOSS and selling predominantly from the UK, to EU

UK VAT registered merchants.

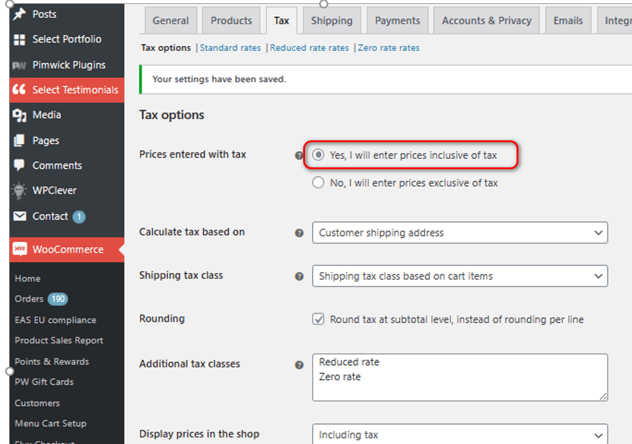

We highly recommend that UK merchants who are registered for VAT use inclusive pricing model for their EU sales. That means that prices in the catalog already contain VAT.

Settings for tax options:

This model means that prices in the catalog are kept with VAT in the catalog. Price in the shop with the properly set geolocation will render VAT-inclusive prices for UK and EU.

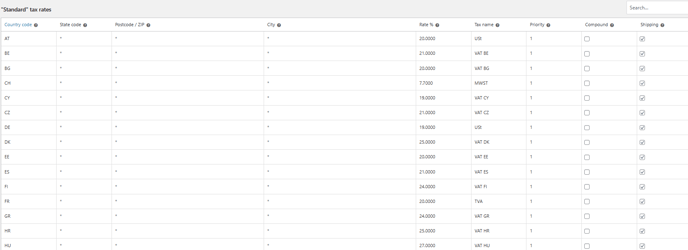

Tax rates should contain GB with 20 percent VAT for standard rate products in this configuration.

Pricing model example:

UK item price 12 GBP (inclusive of 2GBP VAT)

EU price (Denmark, 25 percent VAT)

12/1.2 (UK VAT removed) *1.25 (Danish VAT aded) =12.5 GBP , inclusive 2.5 GBP Danish VAT

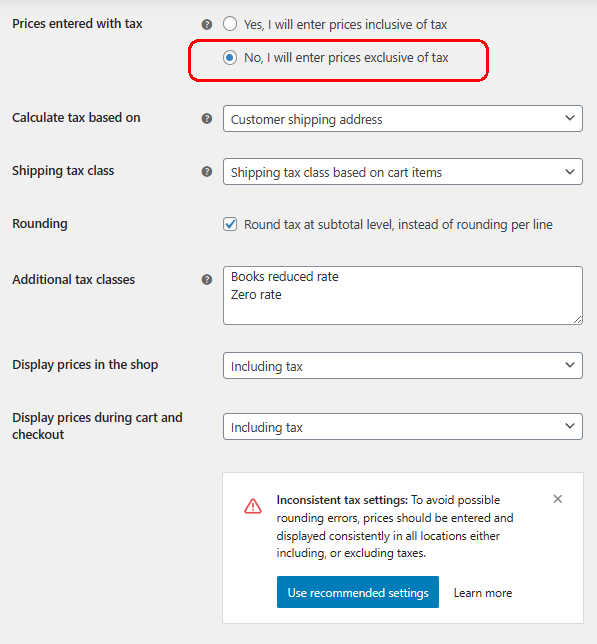

Merchants not registered for UK VAT

For Merchant that do not collect VAT in the UK we propose that VAT exclusive model would be used. Prices in the catalog are to be entered without VAT :

Price in the shop with the properly set geolocation will still render VAT-inclusive prices for EU.

Tax rates should not contain GB line in this configuration.

Pricing model example:

UK item price 12 GBP (VAT in the UK is not collected)

EU price (Denmark, 25 percent VAT)

12*1.25 (Danish VAT added) = 15 GBP , inclusive 3 GBP Danish VAT