When orders are collected from the e-commerce platforms Royal mails Click&Drop sometimes collects item’s price incorrectly and would include VAT into the price, while it has to be shown without VAT

This causes additional problems and leads to a situation when destination postal office disqualifies the shipments as applicable for IOSS.

These situations occur when:

- Prices are set as VAT inclusive in your store’s catalogue

- The overall cost of items, net inclusive is over 150 EUR, but the order is still below the IOSS threshold.

Example:

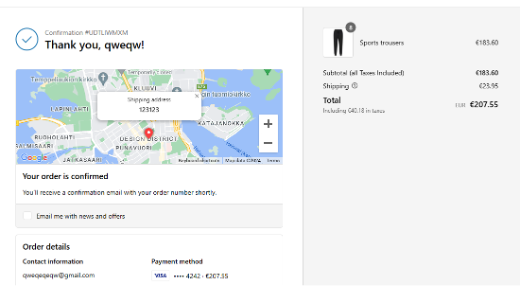

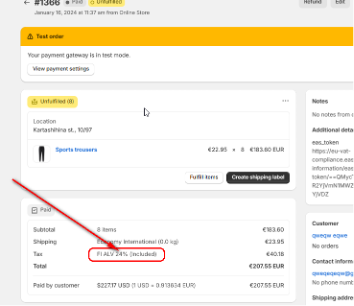

Order is made to Finland, 8 items (Sport trousers) each worth 22.95 EUR (VAT inclusive) are purchased. Shipping is 23 .95 (VAT inclusive)

The order is IOSS since it is below the 150 EUR threshold:

(22.95*8)/1.24=148.06 EUR.

Total order value is 22.95*8+23.95=207.55 EUR

Total VAT of 40.18 is calculated by your Shopify store and paid by the customer:

Note that all prices in Shopify order breakdown are given VAT inclusive.

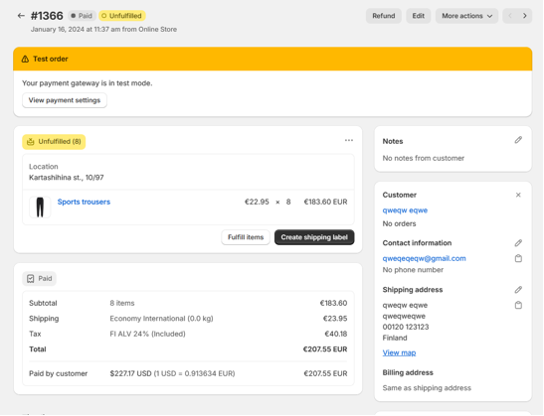

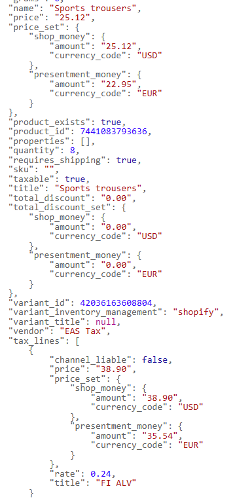

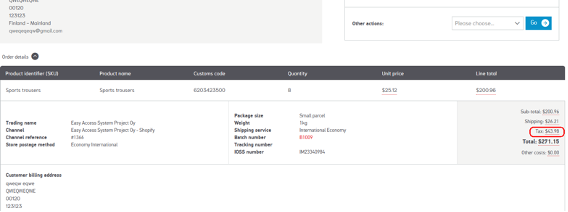

During the order transfer from Shopify to Click&Drop, Click & Drop collects VAT inclusive price of merchandise. The price is collected in the shop currency (USD), not the order currency (EUR). The mistake is due to the way how the data is transferred by Shopify – it always comes Vat inclusive with VAT shown separately. But Click & Drop does not calculate and subtract VAT from the gross price:

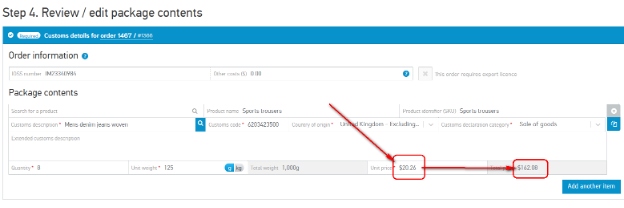

As evident from the Click & Drop dashboard picture the item price was taken with VAT in the store currency

22.95/0.913634 (USD/EUR exchange rate) = 25.12 USD and setting total items cost at 200.96 USD , well over 150 EUR threshold.

Value that should have been shown at this stage should be:

22.95/0.913634 (USD/EUR exchange rate) /1.24 (Finnish VAT removed) = 20.26 USD, making total merchandise cost 162.08 USD.

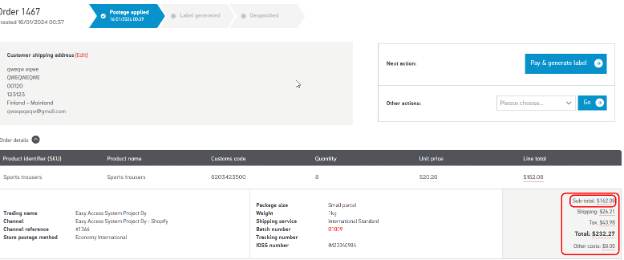

At the next stage Click&Drop add VAT on top of the inflated price making order even more expensive:

VAT presented in the final calculation by Click and Drop is not really the VAT based on the items and shipping cost, but a number taken from original Shopify order and converted into the shop currency : 40.18/0.913634 =43.97.

Total resulting order sum 271.15 (200.96+26.21+ 43.97) makes little sense and cannot be properly interpreted.

Proper calculation here has to read:

162.08 net of VAT price of items

21.14 (shipping without VAT)

43.97 (VAT on items and shipping)

Total 227.19 USD

The overall result of this mistake brings numerous issues on the destination postal operator side, most important ones are:

- Order is not recognised as IOSS and taxes are charged to the customer by the destination customs.

- The amount of VAT charged to the customer may be considerably higher than it should be. In most cases destination postal operator will charge taxes based on the quoted merchandise cost and the cost of shipping: (200.96+26.21 (shipping cost))*0.24= 54.52 USD instead of 43.97 USD

How to prevent

In order to prevent this issue from happening the following actions should be taken:

1. Insure that the order is IOSS in your Shopify store:

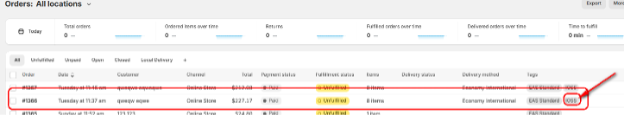

It can be checked in the list of orders – look for the IOSS tag.

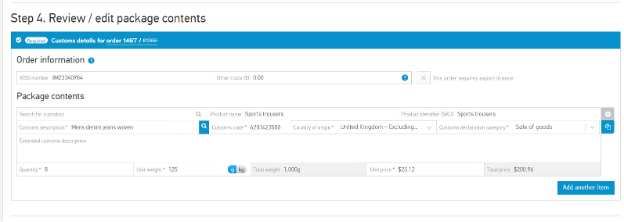

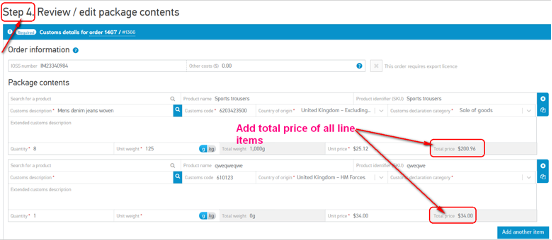

2. Check the value of the order in the Click&Drop dashboard on the Step 4 of postage applying process, for that you should add the total price of all line items (see picture below, another item is added to display the process properly).

3. If the order value is over 150 EUR/180 USD/135 GBP , introduce manual changes to the line item cost reflecting the real situation with the net of VAT item value.

For that take the line item cost shown on the form (25.12) and remove destination country VAT (divide by 1.24 for Finland , 1+24/100, Finnish VAT rate being 24 percent):

25.12/1.24=20.26 USD

VAT rate can be taken from the Shopify order :

Total price of the line item will be calculated automatically by Click&Drop – 162.08 USD

Save the order, check again the total order value (cost of all line items) and continue with payment and printing of labels.

As a result, the total order calculation will look like:

Which is still wrong on the total order value due to the fact that Shipping is shown and taken into calculation with VAT, while VAT should have been removed, but that cannot be resolved.

But the items value data put forward into the postal system would be correct and the order will be considered as IOSS by the destination postal operator.