This document provides comprehensive guidance on handling returns, post-sale discounts, and double payments of VAT for IOSS in Shopify

Table of contentsReturn or Exchange Handling

For VAT purposes, a return or exchange of IOSS items is considered complete only when the items are physically returned to your store from abroad. In Shopify, this translates to restocking items within the store. EAS automatically detects restocking and initiates the necessary steps to claim VAT on the returned goods.

If an order is returned by the logistics provider or customer, regardless of the reason, you must perform a restock. This applies to both unfulfilled and fulfilled orders.

If you plan to replace the order rather than refund the customer, you don't need to provide a refund. In this case, ensure the refund value is set to zero. If you intend to refund the customer, proceed with the standard refund process.

If you want to refund the customer without returning items to stock, you must initiate a manual return in the EAS dashboard.

Example of exchange

- Choose the order and start the refund

- Make a refund with restocking

- Items are now restocked

-

Once you're prepared to send the replacement order, create a new manual order for the same customer. Follow these steps in Shopify:

1. Access the "Drafts" section in Orders and select "Create new order."

2. Choose the items you want to include in the replacement order.

3. Enter the same customer's details as the original order.

4. Verify that taxes are enabled for the order.

5. Mark the order as "Paid" manually.

6. Save the new order.

EAS collects the return and the new order automatically.

Post-Sale Discount Handling

Post-sale discounts are common occurrences where customers receive a refund for a portion of the merchandise value after the order has been shipped. These discounts can arise from various reasons related to the merchant-customer relationship.

EAS cannot directly retrieve partial refund information from your store. Therefore, you must manually log post-sale discounts in the EAS dashboard.

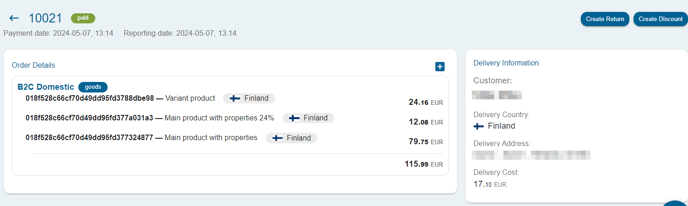

To log a post-sale discount:

- Navigate to the "Orders" section in the EAS dashboard.

- Locate the order you want to reimburse and click on the order number. Order details window will open

- In the upper right corner press "Create Discount"

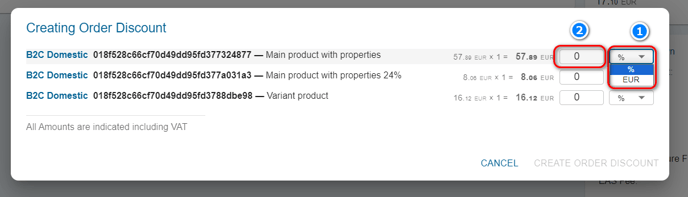

- In the dialog window for each item provide the desired discount amount, either as a percentage or a fixed amount.

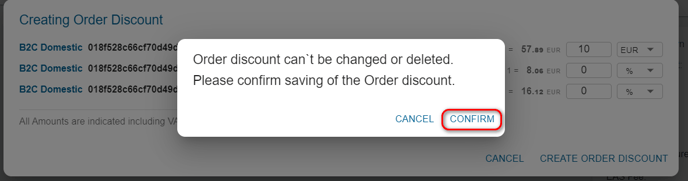

5. Press "Create order discount"

6. In the confirmation window Confirm the discount, and EAS will create the necessary fiscal entries.

If the discount was applied in the same month as the original order, the corresponding VAT amount will be deducted from the monthly fiscal report. In cases where the discount is applied in the subsequent month, EAS will automatically create a correction entry for the post-sale discount VAT.

Remember to retain documentation, such as a copy of the order from your Shopify shop, to support the refund of the discount VAT.

Handling Double Payment of IOSS VAT

This situation can arise when postal operators, courier companies, or shipping aggregators mishandle data transfer or fail to provide the IOSS number or misrepresent the merchandise value in the shipped order. As a result, the customer is charged VAT twice, once at checkout and again at customs.

To correct the double payment of VAT follow these steps:

- Create a refund of VAT without return in your Shopify store.

- Access the EAS dashboard and navigate to "VAT corrections."

- Select "Submit new" and follow the instructions for creating a correction entry.

- Provide the necessary information, including the report type (IOSS), country of order consumption (EU), order year and month, VAT correction amount, correction currency, correction type (deduct), and supporting documentation (customer notification and payment receipt).

- EAS will review the correction and either approve or reject it. If the correction is rejected, you'll receive an explanation and will need to repeat the process.

Notice: On EAS Dashboard corrections you can only correct the amount of VAT paid on the order.