This guide provides a step-by-step process for integrating QuickBooks Online Global with Shopify to handle the IOSS tax scheme for non-EU merchants. It covers prerequisites, setting up tax agencies, mapping tax rates, and managing EU VAT in QuickBook

E-Commerce Environment: Shopify (all plans)

Accounting Environment: QuickBooks (including multicurrency)

Applications: QuickBooks Online Global

Limitations

This guide covers the general handling of the IOSS scheme for non-EU merchants connecting QuickBooks to Shopify using the standard Shopify QuickBooks application (QuickBooks Online Global). Other bridging solutions might use different tax mappings. This manual doesn't include steps for installing QuickBooks Online Global on your Shopify store. For installation instructions, visit the Shopify App Store.

Prerequisites

Your Shopify store must be set up to calculate taxes for the EU.1. Set up initial bridging in your Shopify store

Open Applications and choose QuickBooks Online Global.

A new tab will open in your browser showing main QuickBooks settings

Make sure that the first option (“When an Order is created in Shopify , create a Sale in QuickBooks Online”) is enabled :

Initially, you will have no taxes mapped in the application.

Ensure that the option "When an Order is created in Shopify, create a Sale in QuickBooks Online" is enabled.2.Set Up IOSS Tax Authority in QuickBooks

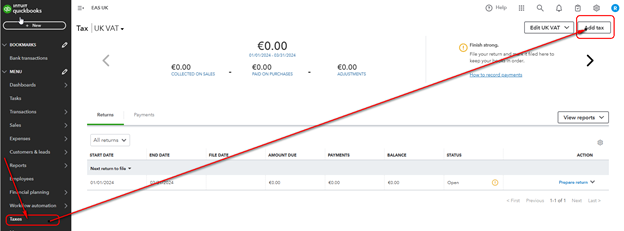

Access the Tax View:

Open the tax settings in QuickBooks.

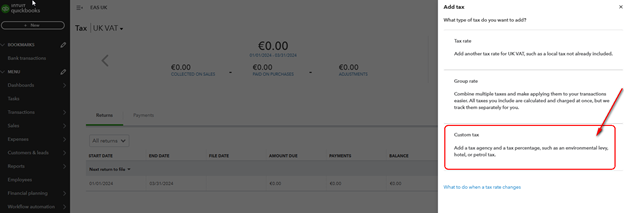

Create a New Tax Agency:

- Select "Custom tax" and input settings for the new tax agency.

- Apply taxation to sales only and set a 0% VAT rate for the agency. Save the settings.

Add Tax Rates:

-

- Select the newly created agency (IOSS) and click "Add tax".

- Fill in the tax data for each EU country.

- Fill in the new country tax data for the IOSS tax agency :

Come back to the Shopify store and ensure that overrides for reduced VAT rates are setup:

-

- Add overrides for reduced VAT rates used for your products in your Shopify store. skip this step if you do not apply reduced rates to your merchandise.

- You can check EU VAT rates here.

- Add overrides for reduced VAT rates used for your products in your Shopify store. skip this step if you do not apply reduced rates to your merchandise.

- Ensure that rates in your IOSS tax agency correspond to rates in your Shopify store.

3. Map Rates to Shopify Sales

-

Initial Mapping:

- Press "Review" and map the tax rates from Shopify to the correct rates in QuickBooks.

Make sure you map the tax rates from Shopify store to the correct rates set for the IOSS tax agency.

- After syncing, orders will transfer to QuickBooks with the mapped tax rates.

4. Handling IOSS Taxes in QuickBooks

EU VAT Handling:

All EU VAT will be handled on one tax account named IOSS in the Chart of Accounts.

All EU VAT will be accounted in the credit of this account:

Currency Exchange Rates:

QuickBooks applies current or set exchange rates, which might differ from the IOSS report if they are made in currencies other than your default currency. That may lead to the exchange rate difference between the booked value and the IOSS report. In the IOSS report EAS will use the exchange rate applicable on the last day of the reporting period. Exchange rate difference should be adjusted manually when the IOSS VAT account is closed monthly.

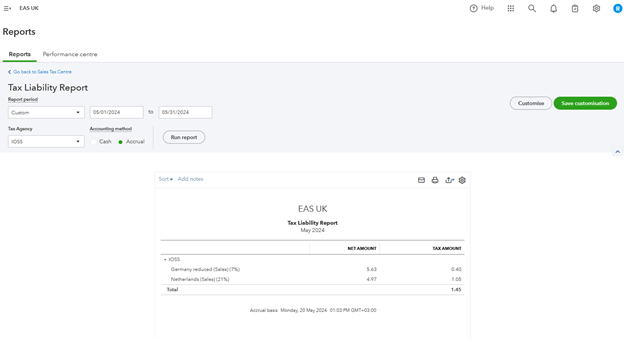

Generating Tax Liability Reports:

Reports can be generated for EU sales, showing sales breakdown by country.

Closing IOSS VAT Account:

Close the IOSS VAT account monthly in correspondence with the bank for the VAT paid to EAS. Treat exchange rate differences manually.

Handling Non-IOSS Orders DDU orders , B2B orders

Mapping Non-IOSS Orders:

Map non-IOSS orders (value over 150 EUR and B2B orders) to the default rate of IOSS tax agency (0% VAT).

Order example

A new mapping is to be done same as for IOSS orders

Mapping fixed:

Non-IOSS Orders in Tax Reports:

Non-IOSS orders will appear separately in the tax reports.

UK VAT Filing:

Report all EU sales as exports with 0% VAT in the UK domestic VAT return (included in box 6 as “exports”).

By following these steps, you can ensure that your Shopify and QuickBooks integration handles the IOSS scheme efficiently and complies with EU VAT regulations.