Your tax settings must be correct in your WooCommerce store for compliance. Follow these instructions to configure your tax settings in WooCommerce.

WooCommerce Tax settings are the most important part of the EAS EU compliance plugin installation.

The following steps should be performed to configure WooCommerce tax settings for the use with EAS EU compliance solution:

- Backup your current tax settings

- Check WooCommerce tax engine status

- Removal of EU rates from the tax rates lists

- Setting the tax options in accordance with the business model

The complete procedure is explained in the Owners manual available to EAS clients.

-

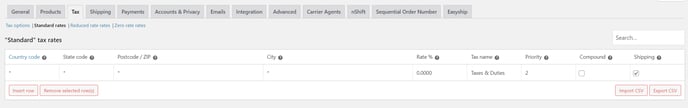

Backup your current tax settings

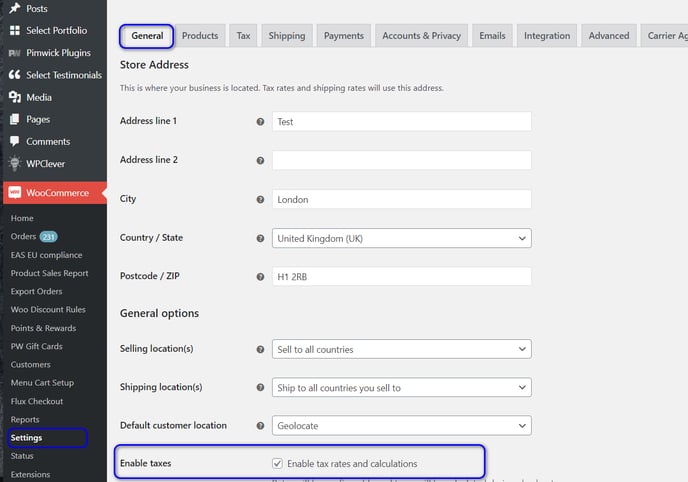

2. Check WooCommerce tax engine status

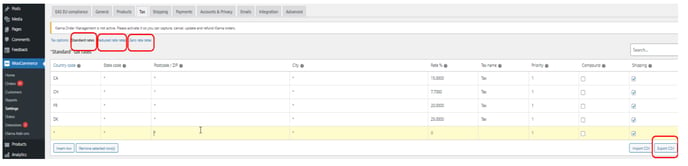

3. Removal of EU rates from the tax rates lists

Remove all EU countries' tax rates from the list and leave tax rates for other countries (for example for the UK, CH and Canada if you support shipping and tax calculation for these countries ). Power up the EAS plugin. The result should look as below:

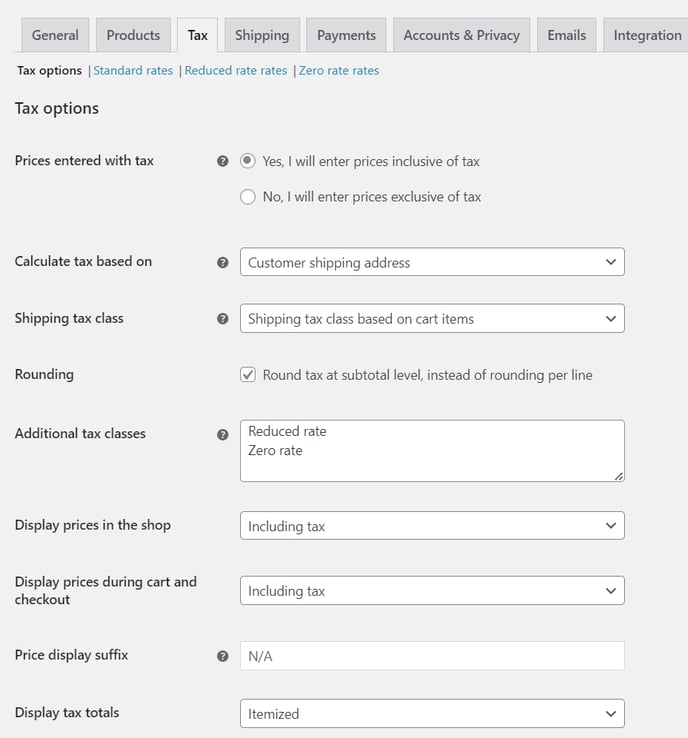

4. Set up the general tax options in accordance with the used business model

Depending on the way how you want to display processes in your store, special schemes that you use, and the way you handle sales to non-EU countries, set up the tax option. Please, refer to sections, "Typical installation for UK (IOSS)", "Typical installation for CH (IOSS)" for setting up stores that use only IOSS scheme for sales to EU from UK and Switzerland, and "Typical installation for EU shop (Union OSS)"

Typical installation for inclusive pricing EU-based shop is shown below: