Providing your IOSS and UK VAT numbers to Swiss Post ensures your shipments are handled appropriately.

The document does not describe integration of your shop Swiss Post into “Webshop connector international” service. You can find more information on this subject here: https://www.post.ch/en/customer-center/online-services/webshop-connector-international/info

“Web shop connector” is a free convenient tool built by Swiss post for uploading data from most commonly used E-commerce platforms and for bulk handling of shipments.

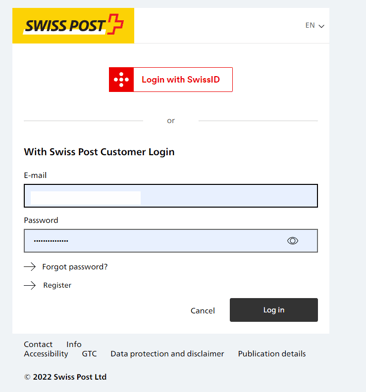

1. Enter the Swiss post portal at: https://account.post.ch/, input your access credentials

2. Choose “Online services” and then choose the service “ Webshop connector international" service and press “Start”

3. Choose your store and then “Shop administration ” at the bottom of the page :

You have to repeat this process for every integrated shop. Settings are saved for every shop individually.

4. Choose "Tax numbers” and input your IOSS and/or UK VAT number.

IOSS number should include IM at the beginning and the UK VAT number starts with GB.

Repeat the procedure for all integrated stores.

Note that if you have any Marketplaces *Amazon, Ebay etc. you may need to use their IOSS and UK VAT numbers , not the registry numbers you have received from EAS.

You can also input other tax registry numbers that you may have for Australian and Norway in this section.

5. Do not forget to press save at the bottom of the page after you have input your IOSS/ UK VAT number

You are all set to use Swiss post Web shop connector with your IOSS and UK VAT number!