Providing your logistics partner Easyship the IOSS number correctly ensures your shipments are handled appropriately.

Inputting the IOSS Number

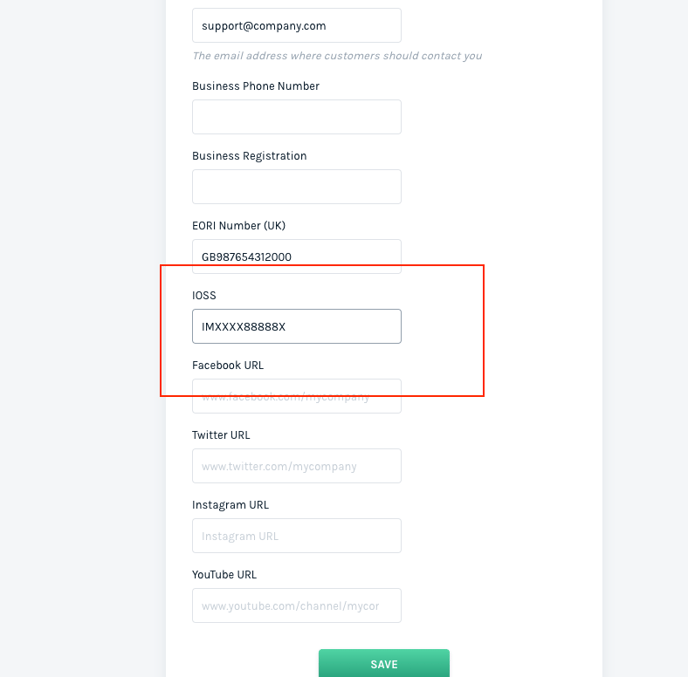

The best way to input your IOSS number is via the Company page on your dashboard.

To Access this, navigate to Account > Company and scroll down to IOSS:

Note:Whenever you remove or update the IOSS number, all the shipments under the Advanced category will be recalculated to reflect this change.

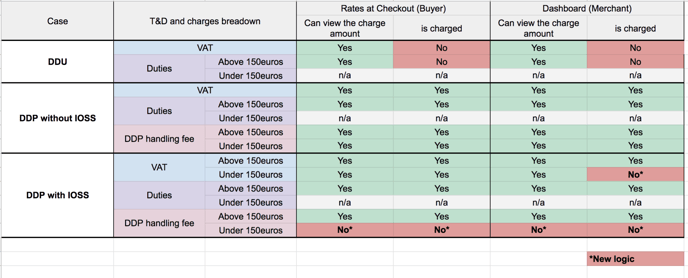

How IOSS works on your account

This table displays the rules in the different scenarios for Cases, Amounts, and Taxes & Duties breakdowns;

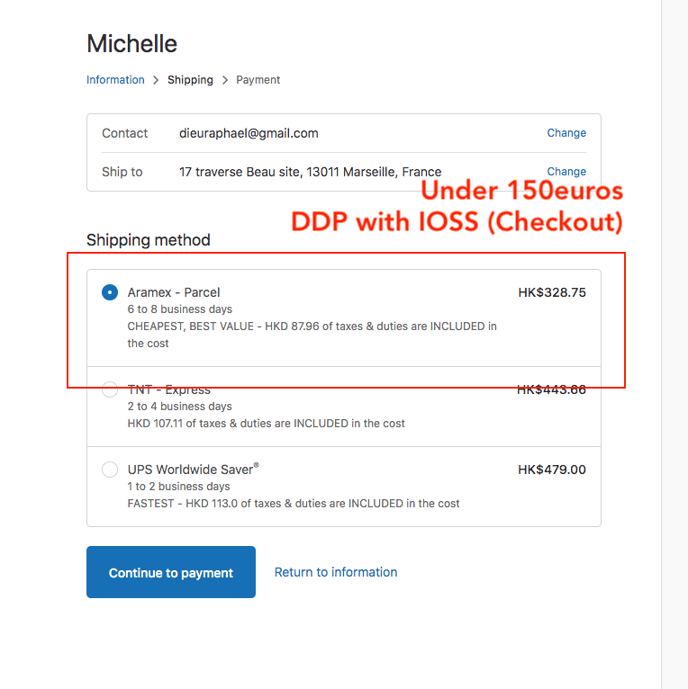

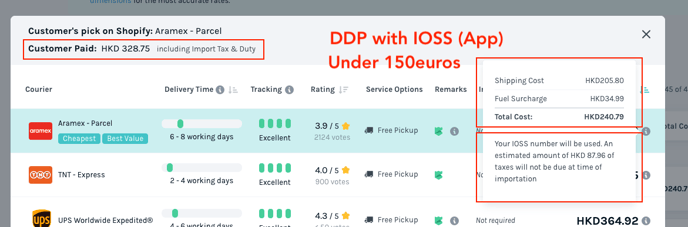

Example of DDP with IOSS (App) - Shipment value under 150 euro

If you are shipping to Europe from Hong Kong, and the declared value is less than 150 Euros, then at Checkout, taxes will be shown and charged;

HK$240.79 of shipping + HK$87.96 of taxes = HK$328.75

In your Easyship account, taxes are shown for reference but not charged, however, HK$240.79 of shipping costs are charged, HK$87.96 of taxes are just shown as a reference. This is because your customer has successfully paid for taxes at the point of sale and therefore you do not need to pay it again on your account for the shipment;

Monitoring your IOSS

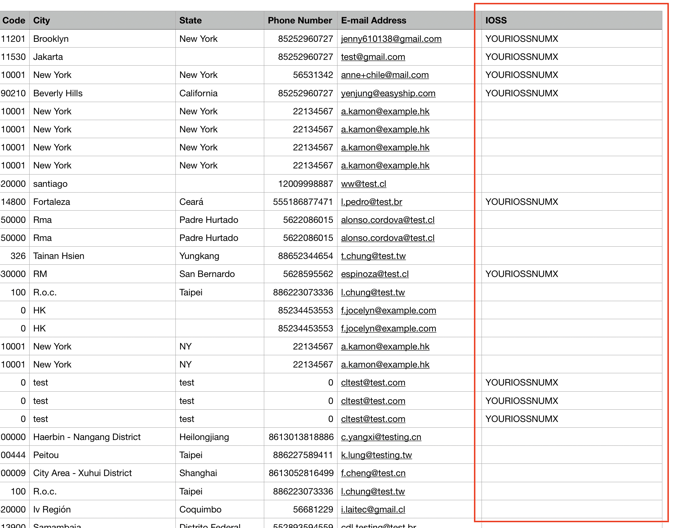

We have added an additional column to the Shipments Export on your account so you can check to see if your IOSS number was used at the Shipment level;

Link to original article:

https://support.easyship.com/hc/en-us/articles/4407848295437-Setting-Up-IOSS-on-Easyship