EAS eases the accounting burdens when accounting for cross-border sales with our precise and easy to use reports

EAS versus standard E-commerce sales reports

The cornerstone of EAS EU VAT solution is the provision of multiple precise and easy-to-use sales reports.

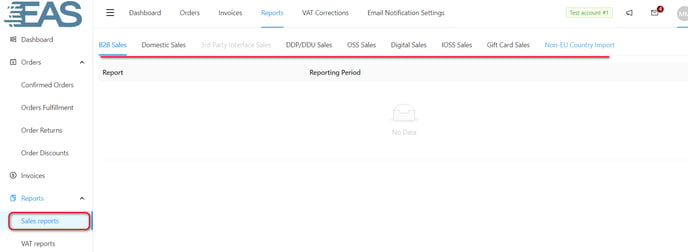

All sales reports are available to Merchants via the EAS Dashboard (see Fig. 1)

Figure 1. Reports in EAS Dashboard

Merchants have the following sales identified in EAS reports:

- B2B report – for cross-border EU B2B sales;

- Domestic – B2B and B2C domestic sales for all existing EU VAT registrations;

- Electronic Interface facilitation – sales report for marketplaces when Marketplace is not responsible for VAT (Articles 14a 1 and 2 of EU VAT Directive)

- DDP/ DDU – sales report for imported goods with intrinsic value over 150 EUR (FC rep)

- OSS sales – reports for sales falling within special EU VAT Scheme OSS

- Import OSS sales - reports falling within the special EU VAT scheme IOSS

- Digital sales - reports for sales falling withing the special EU VAT scheme non-Union

- Non-EU sales - reports for sales to EAS supported non-EU countries

- GIFTS – report on sales of gift cards and other items that are sold VAT free

EAS provides the full set of data with full breakdown for the merchant to decide how to utilise it.

EAS always provides the full set of data with full item level breakdown available. What data is used and how is up to merchant and their accountant. Sales data should be transferred to the accountant as CSV / excel file containing item level sales data, with VAT separately identified. Most of the e-commerce platforms allow for export of various reports, including sales and tax reports. EAS sales reports are more extensive and easy to use for accounting purposes than standard reports.

EAS reports also contain full data on returns and post-sale discounts which are not present in standard or plug-in sales reports from e-commerce platforms.

When EAS EU VAT Compliance Solution is fully integrated, EAS sales reports contain data on reduced VAT sales.

EAS sales reports can easily be mapped for direct upload into accounting solutions.

Simplified accounting scheme for special IOSS and OSS schemes.

Example of a simplified accounting scheme for IOSS and OSS schemes.

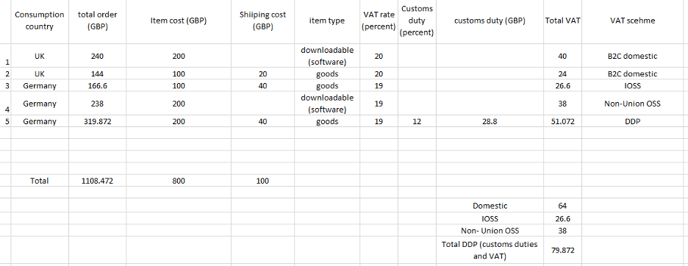

Example used here is for a UK based merchant using both IOSS and Non-Union OSS Schemes and also sends orders over 150 EUR as DDP, customs duties and VAT is collected for such orders. For simplicity all sales are in GBP

5 sales are made by the Merchant in the reporting month

Fig 2

EAS prepares the following sales reports

![]()

Fig 3

Non-Union OSS report

![]()

Fig 4

DDU/DDP report

![]()

fig 5

In the example the shipping cost is accounted as part of the cost of sold merchandise. DDP items are handled by DHL courier service provider (DHL handles also customs clearance in the destination countries)

The following entries are taken to the merchant’s books:

1. For the full sales, at least once a month

Debit “Trade receivables”: 1108.47 GBP

Credit “General sales”: 900 GBP

Credit “VAT”,(All VAT collected : domestic , IOSS, OSS, DDP) : 208.47 GBP

2. For the amount of IOSS sales (net of VAT) as provided in EAS IOSS sales report (at least monthly):

Debit “VAT” : (IOSS, Non-Union OSS VAT and duties due on DDP) 144.47GBP

Credit “VAT IOSS sales” (Value of IOSS VAT) : 26.6 GBP

Credit “VAT Non-Union OSS sales” (Value of Non-Union OSS VAT) : 38 GBP

Credit “Other creditors (DHL)” (Collected customs duties and VAT): 79.87 GBP

Credit saldo on “VAT” account is domestic UK VAT , 64 GBP

As a result of the above entries domestic and IOSS/OSS sales and VAT will be easily accounted for on separate accounts allowing easy preparation of domestic VAT report since non-domestic sales are removed from report.

On the UK domestic VAT report sales to EU turnover (580 GBP) should be reported with 0 VAT as export sales. Domestic sales of 320 GBP will be reported with UK VAT of 20 percent.

3. Monthly for the amount of IOSS VAT

Debit “VAT IOSS sales”

Credit Bank (or “Other creditors” and then closed to the “Bank”)

This amount will always coincide with EAS IOSS fiscal report.

4. Quarterly for the amount of OSS VAT

Debit “VAT Non-Union OSS sales”

Credit Bank (or “Other creditors” and then “Bank”)

This amount will always coincide with EAS Non-Union OSS fiscal report.

Extension of the simplified accounting

Merchants who require more detailed analytical accounting can use EAS reporting for this purpose.

Based on EAS sales reports all accounting entries can be made on item/order level for extended analytics. We propose that IOSS/OSS sales are credited directly to the IOSS/OSS sales and IOSS/OSS Vat accounts based on sales data.

Incidental costs applicable to IOSS/OSS sales, such as shipping costs, can also be kept on separate accounts / sub-accounts to ensure both proper representation of these costs and possibility to provide cost breakdown for these sales. This data is also available from EAS.

Within the OSS scheme the goods and services can be easily separated. Respective data will coincide with respective sections of EAS IOSS/OSS/DDP sales report.

EAS reporting will provide reliable information both for incidental shipping costs and separate accounting for service and merchandise on item level.

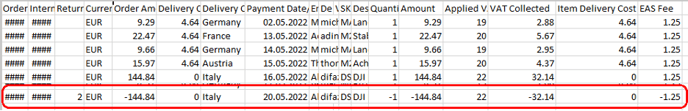

As presented in Fig. 3-5, EAS reports contain data on incidental costs transferred to the end customer on item level representing shipment costs.

Fig 6

In the example above one can see also a return as it is presented in the report. Negative values can be used for accounting of returns that happened in the reporting month.

Domestic and B2B sales identified in EAS reports

EAS sales reports provide full breakdown for domestic (B2B and B2C) and B2B cross border sales with reverse EU VAT scheme used

Fig 7

Above one can see a domestic sales report for Finland, please note that two lines at the bottom represent returns. B2B domestic sales are included into the EAS domestic sales report.

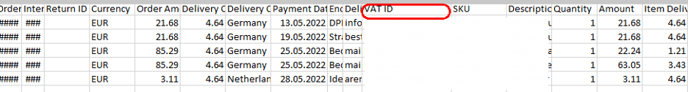

Fig 8

Above one can see an EAS B2B cross-border sales report. All sales are VAT 0 rated due to reverse charge rule that is applied for the sales. VAT ID is always identified in the report, VAT ID validation happens during the sale, validation results can be controlled in the EAS dashboard

For more information, contact us at support@easproject.com